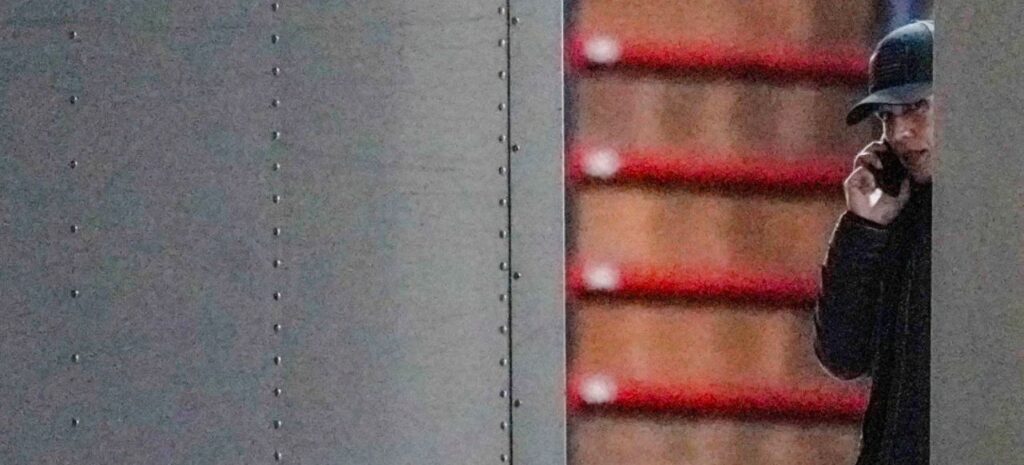

DNI Tulsi Gabbard poking around a Georgia election site

President Trump has been using increasingly dangerous language encouraging his party and his acolytes to take over this year’s election.

This week he encouraged his party to “nationalize” elections. This is yet another completely unconstitutional order. There were many news reports about these various comments, here’s one article: https://www.reuters.com/world/us/trump-says-republicans-should-nationalize-voting-least-15-places-2026-02-02/

I strongly encourage all voters to demand election independence and integrity remain as it has, all our lives, in each of the 50 states.

The President has repeatedly attacked mail in ballots. Like virtually everything he talks about, this is absurd. Mail in ballots are the most secure form of election for a variety of reasons.

Colorado has used the mail in ballot for over a decade now, and it’s worked fabulously. We do NOT need the federal government taking over our elections.

I will continue to push back on this criminal Administration in every manner and capacity I can. I encourage all of you to do the same.